We’re talking round-trip flights and a four-star beach resort.

No matter the time of year, I dream of digging my toes into warm sand. But when the local weather report announced a surprise snowstorm, I pulled the trigger and booked a getaway to the Caribbean for a friend and me.

You might be thinking you can’t afford to do the same. Sure, it’s not cheap to book a trip to a tropical island on a whim. But what if I told you that I paid only $543 for two people, and that cost includes round-trip flights and five nights at a four-star beach resort?

How I Got the Miles to Fly For Free

Several months ago, I signed up for the CitiBusiness / AAdvantage Platinum Select World Mastercard to take advantage of a great bonus they were offering for new cardholders: spend $4,000 on the card in four months and get 75,000 bonus American Airlines miles.

INSIDER TIPThe bonuses that credit card companies offer for new customers change every month. You can check out this card’s current American Airline miles bonus here.

The card earns two American Airlines miles per dollar spent with the carrier directly as well as on cable, mobile phone, car rentals, and at gas stations, plus one American Airlines mile per dollar on all other purchases. So, I spent the $4,000 I needed to earn my 75,000 bonus miles on the card, and that gave me 4,000 miles (thanks to my $4,000 spend) plus my 75,000 bonus miles, totaling 79,000 American Airlines miles in all.

Even if you have no miles in your American Airlines account (it’s free to sign up for one online), the sign-up bonus from the card alone yielded enough points for two round-trip flights to Aruba, a Dutch Caribbean island off the coast of Venezuela.

Recommended Fodor’s Video

As a freelance writer, I own my own writing business and qualify for business versions of most credit cards (you can check out a list of side hustles that make you eligible for a business credit card here). As a consumer, you can earn these miles by signing up for the Citi / AAdvantage Platinum Select World Elite Mastercard.

As with the business version of this card, sign up bonuses change all the time. Keep your eye out for at least 60,000 bonus miles on this card (you can periodically check in for new bonus offers here) or really any card that offers you bonus airline miles for spending a certain amount on the card in a certain period (usually around three months). This card costs nothing for the first year (some cards have an annual fee), which means all the airline miles are yours to redeem as you wish without paying anything up front.

How I Turned Free Miles Into Free Flights

Generally, there are two ways to pay for flights on any airline’s website: with cash or miles. Once you join an airline’s frequent flier program (like AAdvantage) and start earning miles, you can pay for flights in miles instead of cash.

Different airlines charge different amounts of miles for each flight. Most airlines publish the price for a flight in miles on their award chart. You can find American Airlines’ award chart here. Check out the chart and you’ll see that American Airlines charges 15,000 miles for a one-way flight from the United States to any airport in the Caribbean region

Two of us were flying to Aruba and back so I needed 60,000 miles total. Thanks to the sign-up bonus from my CitiBusiness / AAdvantage Platinum Select World Mastercard I had more than enough miles in my account to cover the trip. We still had to pay taxes on our award flights, but those came to just $90.43 per person.

Both the outbound and the return flights included just one layover: one in Philadelphia on the way over, and one in Charlotte on the way back. A similar flight on our dates in March would have cost us at least $584 per person on a different airline, so we saved quite a bit of cash by using miles to cover our airfare.

Cash Cost: $584 per person

My Cost: 30,000 AAdvantage miles + $90.43 per person

Five Nights at Renaissance Aruba Resort & Casino

Now that we booked our flights, we needed somewhere to stay. I planned to use rewards programs and points (hotel chains’ version of miles) to pay for my stay with something other than cash.

Like American Airlines, Renaissance Hotels has an awards program (as do most sizeable hotel chains) that lets members get “free” nights by paying with points. The awards program that Renaissance Hotels belongs to is called Marriott Bonvoy that includes Marriott, Renaissance, Ritz Carlton and a dozen other brands making it the world’s largest hotel loyalty program.

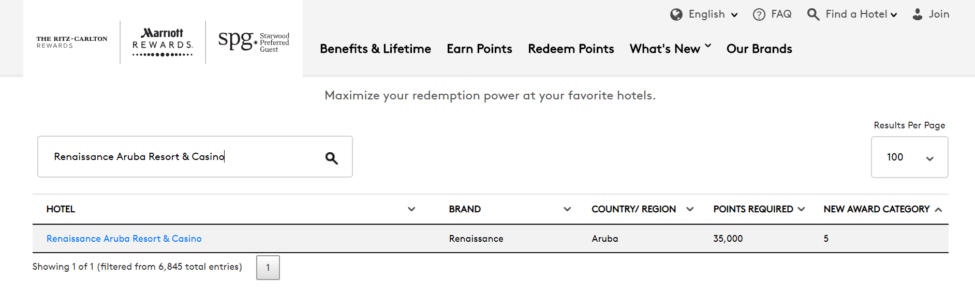

Marriott Bonvoy determines how many points they charge members for hotel stays with their own award chart (you can find it here). Each hotel is assigned a category from 1 to 7 (from budget to bougie) and every category has a price in points. Simply search for your hotel’s name in the search bar to find out its price.

Renaissance Aruba Resort & Casino is a Category 5 Marriott property and requires 35,000 points per night. The hotel no longer had standard rooms available at the time of booking, so I ended up selecting the next available room for 140,000 Marriott points + $172.18 for five nights, including all taxes and fees.

You see, Marriott offers a promo to guests who book five award nights in a row: redeem points for four nights and stay the fifth night for free. This deal is only for members who redeem points for free nights, not for those who pay with cash. Members know that a great way to stretch their points is to redeem them in multiples of five (five-, 10-, 15-night stays, etc.) to stretch them further.

In our case, 140,000 points were enough to book five nights, and the cash copay got us an upgraded island room. Had we paid cash for the whole stay, we would have had to shell out $2,326.49—a sum that’s significant enough to either make us not go on this trip or look for much more affordable accommodations.

I earned these hotel points with my Starwood Preferred Guest and the Starwood Preferred Guest Business credit cards from American Express much in the same way that I earned my airline miles. Both cards offer sign up bonuses. As I write this, the Starwood Preferred Guest and the Starwood Preferred Guest Luxury cars are each offering 75,000 points for new cardholders who spend $3,000 on purchases in the first three months. However, the offers change all the time, so you’ll have to click on those links to see what’s on offer now.

Starwood Preferred Guest cards also offer bonus hotel points for every dollar you spend in different categories (as much as six points per dollar you spend which can turn that $3,000 minimum spend into 18,000 additional hotel points).

You can not only combine your hotel points to redeem a room, you and a friend can redeem your points to earn together. Each card earns bonus points in different categories, and you can combine them into one account and redeem for a room in the Marriott portfolio, which now includes Starwood hotels as well. The chain includes about 6,800 properties in more than 150 countries, and you’re sure to find a property for a vacation to your liking.

Both cards have annual fees of $95, waived for the first year, but I’ve held these cards for years because I receive tremendous value from them even after paying the fees. When my cards reach the next account anniversary, I will be able to get one free night on each card good toward any hotel room worth up to 35,000 Marriott points.

The reason that Renaissance Aruba Resort is appealing to me is that it offers access to a private island with a white-sand beach, kayaking and flamingoes. The hotel also has an adults-only section as well as a family-friendly section, so you can enjoy your vacation the way you prefer.

Cash Cost: $2,326.49

My Cost: 140,000 Marriott points + $172.18 + $190 in annual fees for the Amex Starwood Preferred Guest credit cards

Our Savings

Had I not had access to points and miles, the vacation my friend and I are about to take would’ve set us back $3,494.49. Instead, it cost about $543 for two people after taking into account airline, hotel, and credit card fees.

Using credit card points to cover major aspects of a trip, such as hotel and airfare, leaves more money in your wallet for food and activities you want to do on your vacation. And the best part is, you don’t have to apply for tons of credit cards to create a similar trip. Just a few sign-up bonuses will do the trick, which means two people can apply for a card or two each and enjoy a similar trip to the Caribbean.